Biweekly Mortgage Calculator With Extra Payments And Lump Sum While others only allow it on your mortgage anniversary date.

Biweekly mortgage calculator with extra payments and lump sum Talk to your mortgage choice mortgage broker to find out if lump sum payments are permitted for your home loan.

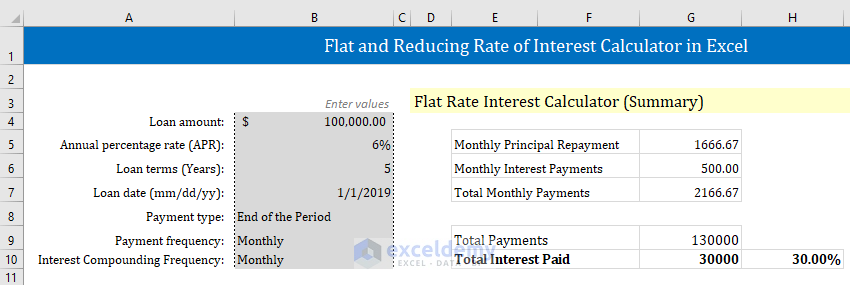

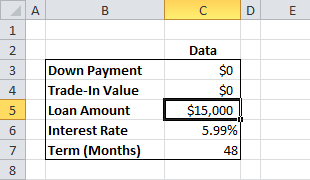

Biweekly mortgage calculator with extra payments and lump sum. The amortization table has all the details about your mortgage payments such as principal interest paid remaining balance as well as tax and insurance. Depending on your mortgage some will let you do a lump sum payment whenever you want to through out the year. This calculator presumes one starts making biweekly payments at the onset of the mortgage. The calculator will use these figures to give you an estimated total interest savings and the new period of time it will take to pay off your loan.

Instead of making one payment every month you ll be making a payment every other week. This saves you 74 973 22 in interest costs. Another strategy is to make an additional mortgage payment a year. With a bi weekly payment you ll be be making 26 payments.

Making biweekly mortgage payments is a strategy that can help you save a lot of money in interest and pay off your mortgage early. If you made regular monthly payments for a period of time before switching to biweekly payments and or want to add extra funding to the payments please. The payment amount for a biweekly mortgage is one half the monthly amount. This bi weekly pattern is distinct from a bimonthly mortgage payment which may or may not involve extra payments.

That s the same as making 13 monthly payments. Lump sum amount lump sum made at. Loan amount interest rate extra repayments start extra repayments from. Make an extra mortgage payment every year.

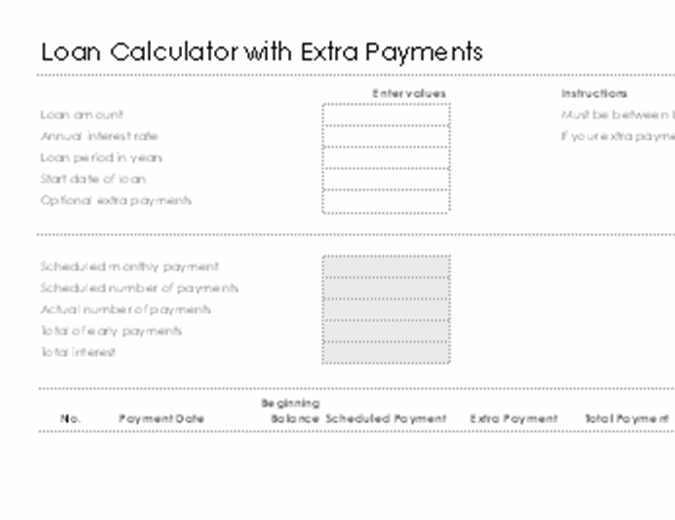

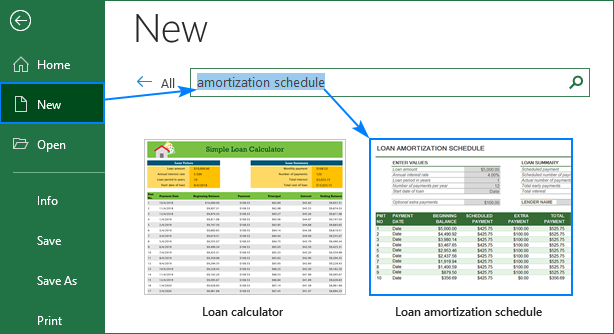

Some lenders will only allow a certain extra amount to be paid off each year without. Extra payment mortgage calculator with multiple extra payments and lump sum has option to export the amortization schedule with extra payments in excel or pdf format. A lump sum mortgage payment is a one time payment that you can put down on your mortgage when you have extra funds. Although this calculator acts as a simple mortgage calculator you can also use it to see how much you can save when you make extra payments regularly or if you make a one off lump sum repayment into the mortgage.

The extra lump sum payment decreases the total interest to 128 260 72. Since there are 52 weeks in a year you ll make 26 regular payments when paying every other week. Use this free calculator to discover how much time and money you will save by making regular biweekly payments instead of monthly payments on your home. The above calculator supports recurring weekly biweekly monthly quarterly or annual payments along with one off lump sum contributions.

Related post Biweekly mortgage calculator with extra payments and lump sum:

- 40th birthday present ideas for him uk

- 40th birthday party decoration ideas for him

- 30th birthday party for men

- 30th birthday quotes for women

- 3d birthday chart for classroom

- 40th birthday gift ideas for sister funny

- 40th birthday gift ideas for best friend female uk

- 40th birthday card for my daughter

:max_bytes(150000):strip_icc()/GettyImages-155420417-0636da199f484064a9ac1e7af2b84012.jpg)